Thursday, April 22, 2021

The "New IT" and Its Impact on Industry Merger & Acquisition Activity

Source: Observations from the Executive Suite

By Jeff Kramer, Managing Director, NRC Realty & Capital AdvisorsThe "Old IT," Information Technology, is as important as ever to the c-store and gasoline industry. But a "New IT" is surfacing in part due to changes brought on by Covid and its aftermath, plus demographic, social, and business changes that were in process but accelerated with Covid. It seems like 6 years of potential trend changes such as working from home were compressed into 6 months.

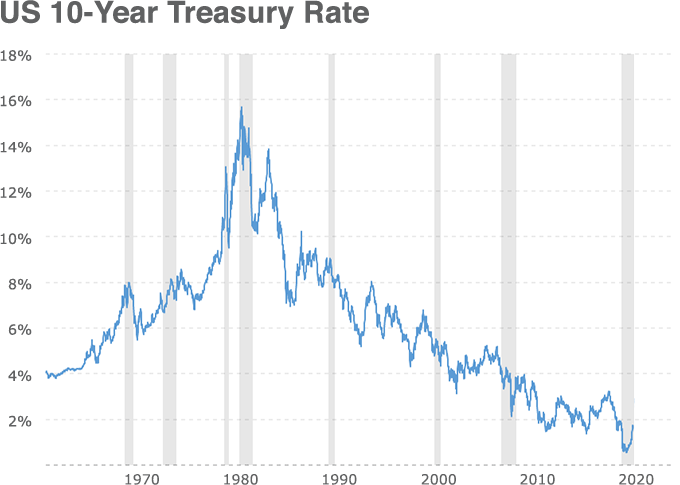

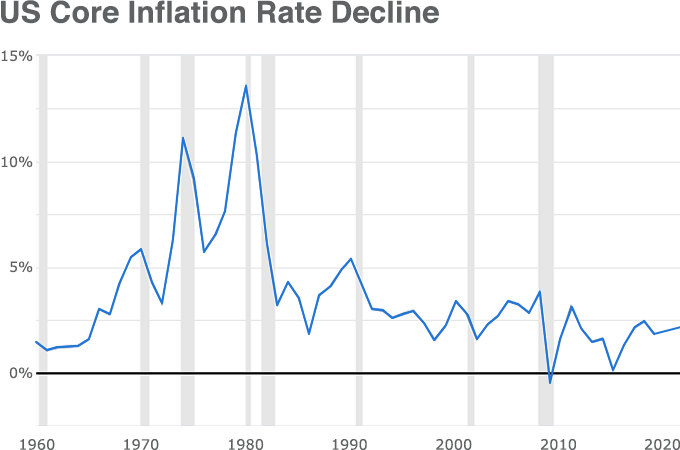

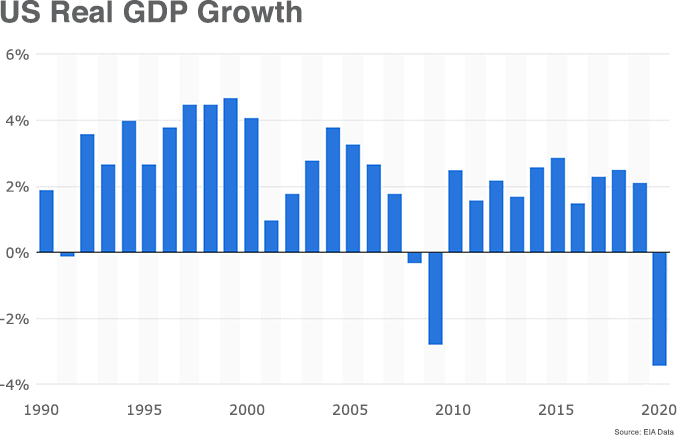

The first "I" in the "New IT" actually stands for both inflation and interest rates. As shown below, interest rates represented by the key benchmark 10 Year U.S. Treasury Note have been on a steady decline since the early 1980’s, pretty much coinciding with a fairly steady decline in overall inflation. The deep, fast recession caused by Covid reactions and shutdowns led to negative interest rates in many countries and zero short term rates in the U.S., a situation that has rarely ever existed. The good news is the subsequent liquidity provided helped to create a sharp economic rebound wherever Covid has been brought under control, at least so far. There is not much question inflation and even shortages of many materials are causing an inflation burst, but the big question is whether it is only transitory or long term which we will not know for a while. Regardless, history shows that a normal economy with about 2% inflation would typically set the key 10 Year Note at about 3.5%, more than double the current rate. Yet most countries are keeping short term rates controlled by monetary authorities at very low levels due to continuing high unemployment rates. They are also raising their country’s Fiscal Spending Deficits to avoid bankruptcies while hoping to promote business and consumer spending. Plus, many key countries are promoting new technologies, one of which is clean energy and electric vehicles that will start to impact gasoline sooner than many of us would like to see. Fewer trips for fuel fill ups also impact convenience store sales over time. New battery technology, and home and office charging will not benefit fueling stops except perhaps on freeways. An aging population is another factor that reduces spending, as shown, for instance, that much of the U.S. Federal "stimulus" payouts have gone into savings accounts.

So, assuming a typical worldwide economic recovery will eventually bring higher interest rates, and as long as inflation and deficits do not get so bad as to burden the economic recovery, a moderate 1-2% increase in rates should not burden M&A activity and selling multiples in our industry. After all, being designated an "Essential Industry" during Covid brought new customers into the store plus an increase in average ticket per sale. Opening up will bring convenient Foodservice back into play again as well. And buyers’ rates of return for quality assets will still be there because new technology, overhead savings, economies of scale, and ongoing labor issues bring improvements to larger buyers and reduce their effective purchase multiple.

The "T" in the "New IT" is for Taxes. It is a huge unknown at this time as higher taxes are fairly certain to pay for at least some of the huge ongoing deficits and debt already established. Industry tax incentives for construction plus markups for increasing the old depreciable base to a much higher base have certainly helped multiples. There’s talk of corporate and personal income tax rate increases, capital gains rate increases, minimum tax rates, estate tax and basis changes, even gas tax increases again for the umpteenth time. It’s impossible to guess which taxes are coming, but most governments are going to be forced to consider everything.

On balance, we remain in a solid industry for good operators who know how to optimize their capital spending and cash flows, and is still looked at very favorably by Wall Street and the banking industry. Each operator must examine their own growth situation as change is inevitable and management and personnel are critical. New builds are lengthy and expensive, while acquisitions are not cheap at today’s earnings and multiples.

Please call me if you would like to discuss any of these subjects, or how NRC can help you in your decision making and long term planning. A free valuation is part of our process.

JEFF KRAMER

Managing Director

jeff.kramer@nrc.com

(303) 619-0611

–

To see a list of convenience stores and gas stations for sale, click here.